As Japan ends its 17-year period of negative interest rates, market volatility is expected as the policy beds in. We look at how market participants can use Interest Rate Swap Volatility indices to their advantage.

This March, Japan became the last country in the world1 to end a policy of negative interest rates.

The Policy Board of the Bank of Japan (BoJ) announced2 that a long period of deflation has come to an end and wages are rising, making it the right time to increase short-term interest rates from -0.1% to 0-0.1%.

The central bank also abandoned yield curve control, a policy that has been in place since 2016 capping long-term interest rates around zero, and discontinued purchases of risky assets.

The BoJ says it will target a 2% price stability target and “conduct monetary policy as appropriate, guiding the short-term interest rate as a primary policy tool, in response to developments in economic activity and prices as well as financial conditions from the perspective of sustainable and stable achievement of the target”.

The immediate response to rising interest rates has been a fall in the yen which dropped more than 1% the day of the announcement. However, the impact on the bond market has been minimal with market participants having largely anticipated the BoJ’s measured increase.

Tactical opportunities

Looking further ahead, if wage-driven inflation grows, long-term yields will likely start to price in the further hikes and term premiums will increase, reflecting the uncertainty over the outlook for inflation and monetary policy.

However, this evolving policy stance presents tactical opportunities for active managers to capitalise on the inefficiencies in the Japanese bond and interest rate swap markets during this period of increased volatility.

Yet to make the most of such opportunities, market participants need an indication of the expected volatility of the swap rates.

Last year Parameta Solutions, the data and analytics division of TP ICAP Group, the world’s largest inter-dealer broker, launched its Interest Rate Swap Volatility (IRSV) indices which provide market participants with a model-free measure of spot implied volatility in the major interest rate swap markets.

Derived from unparalleled access to interest rate swaptions market data, the index consolidates all the volatility information at a specific tenor/expiry into a single measure of implied volatility.

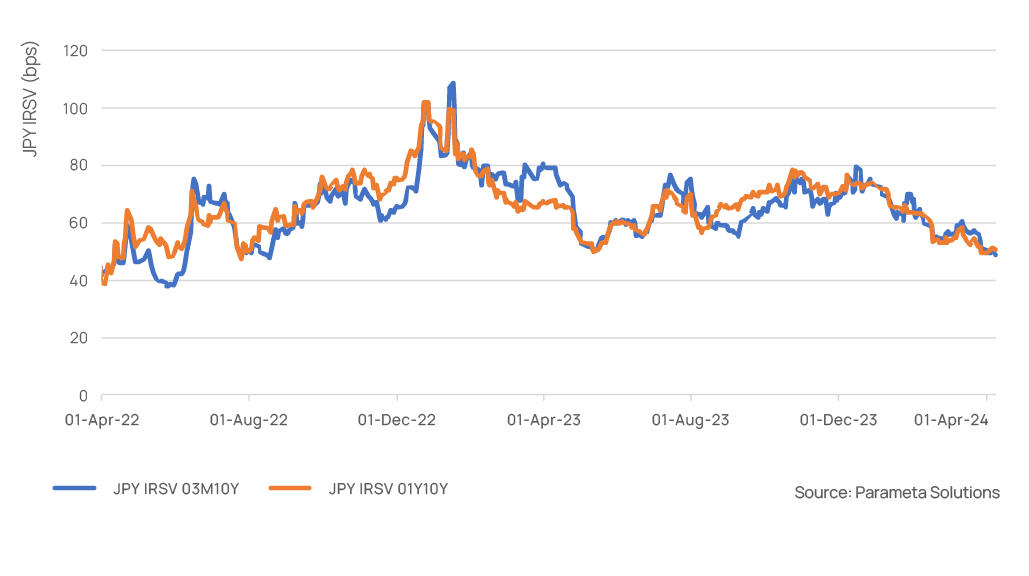

For OTC derivative market players looking at Japan, JPY IRSV offers a basis point measure of JPY Interest Rate Swap Volatility with 35 points on the volatility surface available covering 1Y, 2Y, 5Y, 10Y and 20Y Swap Tenors option with option expiries of 1M, 3M, 6M, 1Y, 2Y, 5Y and 10Y.

IRSV is a model-free measure of implied volatility, and, as a recent BIS working paper3 found, predictions of interest rate swap volatility based on model-free implied volatility have superior predictive power over other commonly used volatility forecasting measures.

For those wanting to take advantage of the more favourable interest rates in Japan, but who want to manage the expected volatility, Parameta’s JPY IRSV indices offer a useful tool to make the most of the markets.

To find out more…

© 2024 ICAP Information Services Limited (“IISL”). This communication is provided by ICAP Information Services Limited or a member of its group (“Parameta”) and all information contained in or attached hereto (the “Information”) is for information purposes only and is confidential. Access to the Information by anyone other than the intended recipient is unauthorised without Parameta’s prior written approval. The Information may not be not used or disclosed for any purpose without Parameta’s prior written approval, including without limitation, storing, copying, distributing, licensing, selling or displaying the Information, using the Information in an application or to create derived data of any kind, co-mingling the Information with any other data or using the data for any unlawful purpose of for any purpose that would cause it to become a benchmark under any law, regulation or guidance.

The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy or constituting financial or investment advice or a financial promotion. The Information is not to be relied upon for any purpose whatsoever and is provided “as is” without warranty of any kind, either expressly or by implication, including without limitation as to completeness, timeliness, accuracy, continuity, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed, to the fullest extent possible under applicable law. In no circumstances will Parameta be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. Parameta may suspend, withdraw or modify or change the terms of the provision of the Information at any time in its sole discretion, without notice.

All rights, including without limitation intellectual property rights, in and to the Information are, and shall remain, the property of IISL or its licensors. Use of, access to or delivery of Parameta’s products and/or services requires a prior written licence from Parameta or its relevant affiliates. The terms of this disclaimer are governed by the laws of England and Wales.