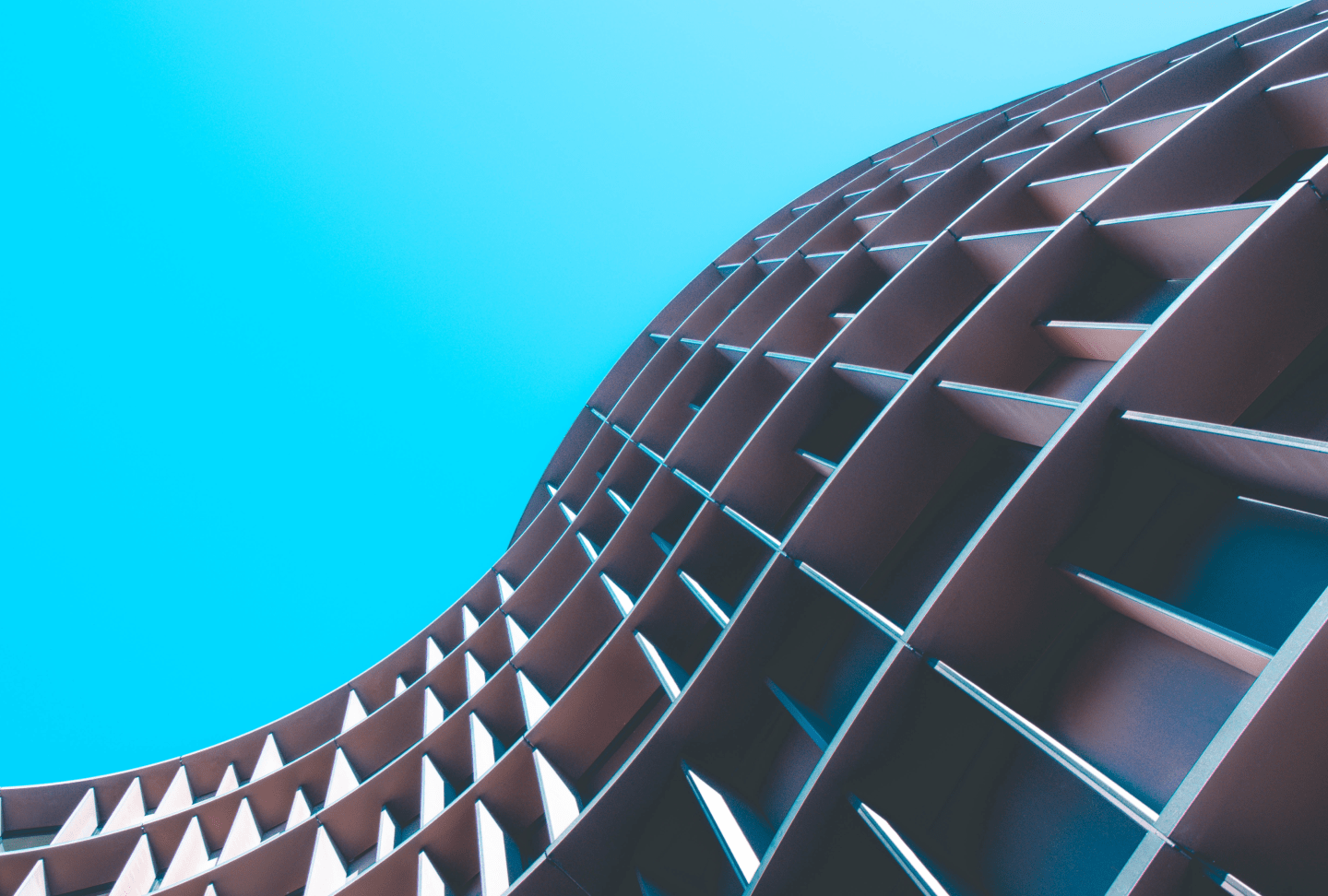

Asset management

Generate Positive Returns

Directly access and query our data through multiple cloud solutions

Achieve your investment objectives

How we support asset management

Generate alpha with broad and deep data pools.

Your potential to outperform the market and deliver additional returns to your investors depends on your ability to get insights and data, quickly, and often straight into your workloads. You can access and interrogate our data through multiple cloud solutions, eliminating the need to extract and transform data before use, giving you the power to seize opportunities, fast.Improve performance monitoring.

Performance monitoring is critical not only to achieving above average returns in-line with your fund strategy, but it is also part of investor's expectations. Clients and investors expect transparency and accountability, this helps build trust and strengthens relationships. Our raw data and our indices can help you track your fund’s performance and demonstrate your ability to generate alpha.Enhance your asset allocation strategy.

A comprehensive market view which includes a wide range of market dynamics, economic trends and risk factors, enhances the effectiveness of your investment strategy. Achieving your investment objectives relies on you accessing a wide range of data to stop you forming biases that could lead to poor performance. Adopting our data into your systems helps mitigate these biases by considering a broader range of factors. This helps you anticipate changes in the market more quickly.Measure your liability driven investment (LDI) strategy.

Balancing your LDI strategy is key to maintaining the ability to meet redemption requests without compromising your portfolio's value. A broad view of data provides you with insight, and thereby the flexibility, to pivot quickly in response to changing market conditions to maintain the liquidity needed to meet your obligations.Asset management products

OBSERVABLE AND TRANSPARENT

Evidential Pricing

Our Evidential Pricing solution combines broker surfaces, committed quotes and transaction data for a representative price. This deeper, broader and more comprehensive view into the markets helps valuations teams with their risk and control processes by delivering comprehensive fair-value data. Currently available for interest rate derivatives, foreign exchange derivatives and bonds.

Stay ahead of the curve

Real-time Indicative Data

We offer indicative data across all assets we cover, which enhances market transparency and enables clients to gauge market sentiment and where value is heading. Risk managers, market makers and valuations teams can use such data to assess pricing levels and the value of over-the-counter instruments. Crucial in promoting efficient markets and fair trading conditions, this data helps capital markets participants to maximise their firm's capital in a dynamic and competitive marketplace.

ANALYSE THE PATTERNS

Historical Data

Our historical data provides a richer understanding of market behaviour and trends. Drawing on more than 20 years of experience across key markets, our data is a rich source for back-testing trading strategies and understanding risk-levels associated with specific investments.

Understand volatility

EUR & GBP Interest Rate Volatility Indices

Providing market participants with a model-free measure of spot-implied volatility in the major interest-rate swap markets. This index is derived from interest rate swaption prices. It consolidates all the volatility information at a specific tenor/expiry into a single measure of implied volatility, delivering an index for each of the 1Y, 5Y and 10Y option expiries on 5Y and 10Y EURIBOR-ESTR and SONIA swap rates. This index may not be used as a benchmark. Please contact us for further information.

Enhance your TCA

Trading Analytics Platform

Our solution supports clients with their TCA process, enabling them to monitor, measure, and uncover insights that assist with achieving best execution.

Markets we cover

We connect clients to a wealth of over-the-counter market data and solutions that cover all major asset classes.

Credit

Energy & Commodities

Equity derivatives

Fixed Income

Foreign Exchange Derivatives

Inflation

Interest rate derivatives

money markets

To find out more about how our solutions can help fund and asset management, contact one of the team