Optimize capital, mitigate risk, and ensure regulatory compliance with access to our comprehensive level 1 and level 2 pricing.

Key Features

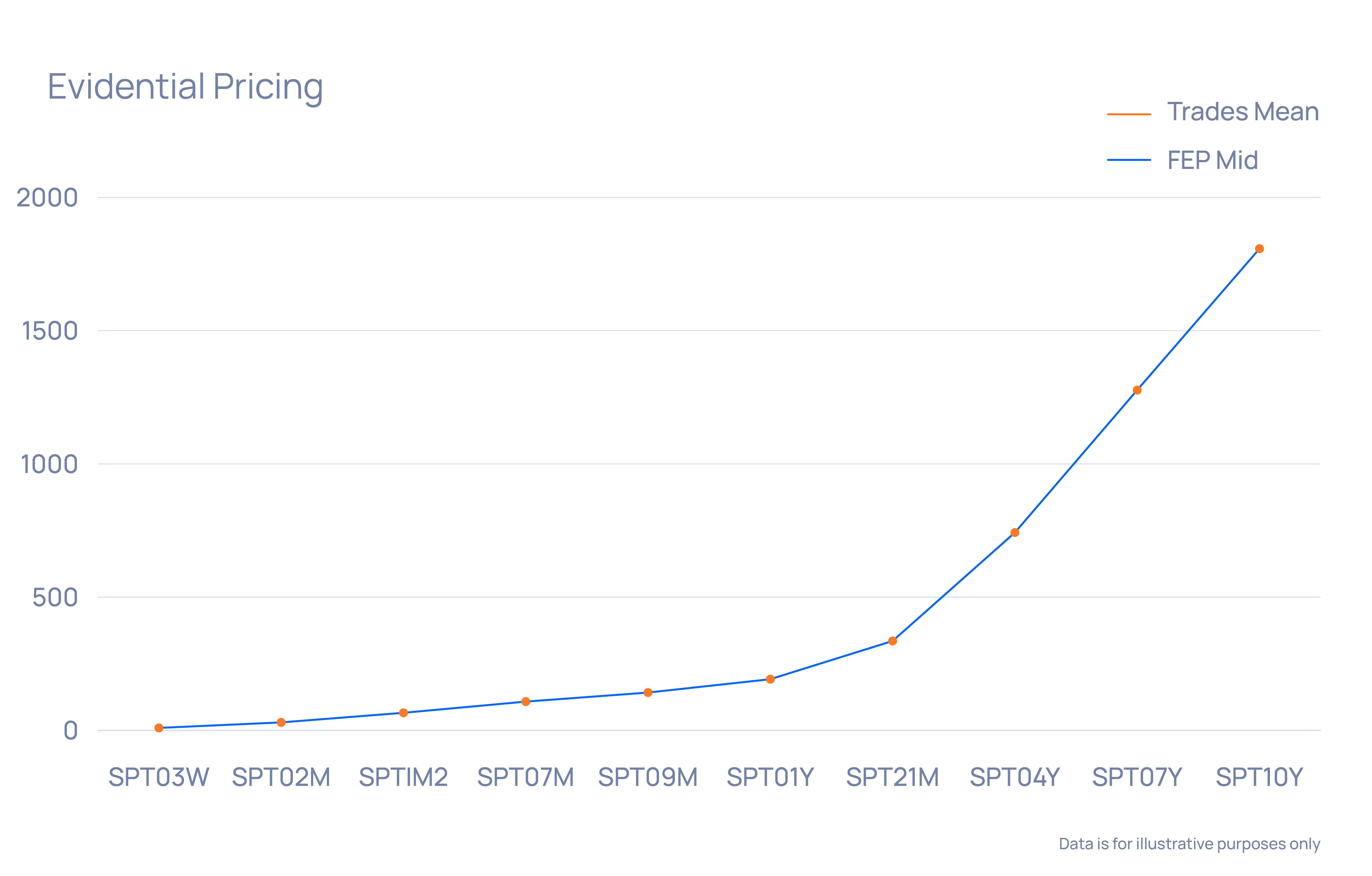

Gain visibility into bid and ask prices, trading volumes, and transaction details with our transparent and verifiable data.

Refine your risk management strategy and reduce capital requirements to access essential level 1 and level 2 pricing data from ICAP and Tullett Prebon.

Understand your risks and safeguard against regulatory penalties

Validate sophisticated risk models and strengthen their predictive power. Navigating an increasingly complex regulatory landscape.

Turn insight into action by leveraging comprehensive data and advanced analytics across various risk and governance functions.

Evidential solution product suite

IRS EURIBOR 6M

Regulatory requirements we can help with

Case Studies

View All Case StudiesContact us to access our data inventory

Latest Insights

The latest opinion from Parameta Solutions.

Contact Us

Have a question? Reach out to us